Smart Money Moves: Browsing Currency Exchange in Toronto

Smart Money Moves: Browsing Currency Exchange in Toronto

Blog Article

Uncover the Keys to Making Smart Decisions in Money Exchange Trading

As traders navigate the intricacies of the market, they typically seek out evasive secrets that can give them a side. By peeling off back the layers of this complex landscape, traders might discover concealed insights that can potentially change their method to money exchange trading.

Understanding Market Trends

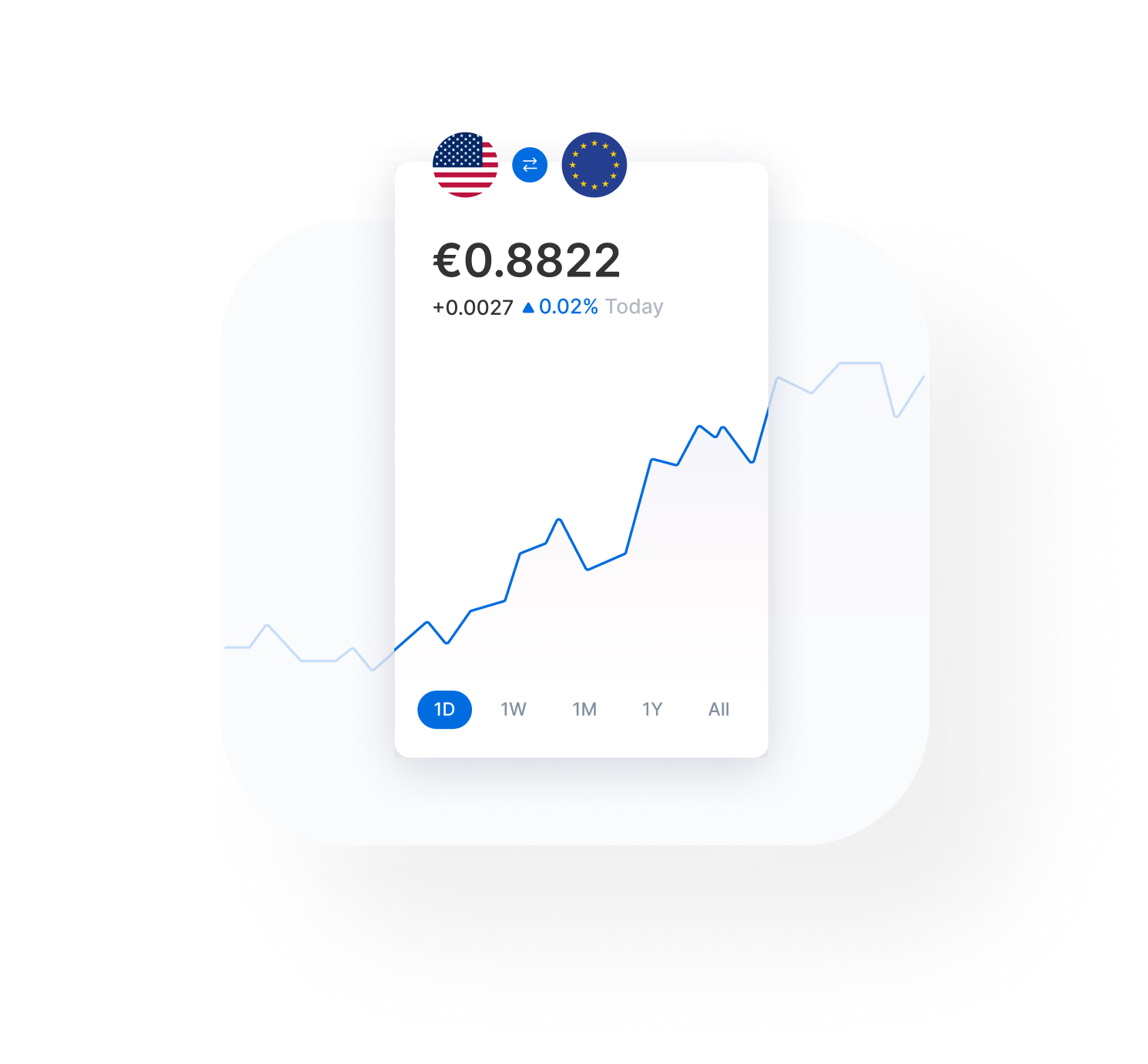

A thorough comprehension of market fads is important for effective money exchange trading. Market patterns refer to the basic direction in which the marketplace is conforming time. By comprehending these patterns, traders can make more enlightened decisions about when to get or market money, ultimately optimizing their revenues and lessening potential losses.

To effectively analyze market fads, investors typically use technological evaluation, which involves researching historic price graphes and utilizing various indicators to forecast future cost movements. currency exchange in toronto. Basic analysis is additionally necessary, as it involves reviewing financial indicators, political occasions, and other variables that can affect currency values

Risk Administration Techniques

Exactly how can money exchange investors effectively reduce possible threats while maximizing their investment chances? One vital approach is setting stop-loss orders to limit losses in situation the market relocates versus an investor's position. By defining the optimal loss they are willing to birth in advance, traders can safeguard their resources from considerable declines.

Furthermore, leveraging tools like hedging can better protect traders from adverse market activities. Inevitably, a computed and regimented approach to take the chance of monitoring is critical for long-term success in money exchange trading.

Fundamental Vs. Technical Evaluation

The discussion in between essential and technical analysis has actually been recurring in the trading area. Some investors choose essential analysis for its concentrate on macroeconomic variables that drive money values, while others favor technological evaluation for its emphasis on price trends and patterns. Actually, effective traders frequently use a combination of both approaches to obtain a thorough view of the marketplace. By integrating fundamental and technological analysis, traders can make even more educated decisions and boost their overall trading efficiency.

Leveraging Trading Tools

With a solid structure in technological and essential evaluation, currency exchange investors can substantially boost their decision-making process by leveraging numerous trading tools. These devices are developed to give traders with useful insights into market fads, cost movements, and possible entry or departure factors. One important trading device is the financial calendar, which assists investors track essential financial occasions and announcements that might influence currency values. By remaining educated about essential financial indications such as rates of interest, GDP records, and work figures, traders can make more enlightened choices about their trades.

Psychology of Trading

Recognizing the right here psychological aspects of trading is necessary for currency exchange traders to navigate the psychological obstacles and biases that can affect their decision-making procedure. It is essential for investors to grow psychological self-control and maintain a reasonable strategy to trading.

One usual psychological trap that traders come under is verification bias, where they look for information that supports their presumptions while overlooking inconsistent proof. This can hinder their ability to adapt to altering market conditions and make knowledgeable choices. Furthermore, the anxiety of missing out on out (FOMO) can drive investors to get in professions impulsively, without performing correct study or evaluation.

Verdict

To conclude, mastering the art of money exchange trading calls for a deep understanding view it of market click here for more fads, reliable threat monitoring approaches, expertise of technological and essential analysis, usage of trading tools, and awareness of the psychology of trading (currency exchange in toronto). By combining these components, investors can make educated decisions and enhance their chances of success in the unpredictable globe of money trading

By peeling back the layers of this intricate landscape, traders may uncover hidden understandings that might potentially transform their strategy to money exchange trading.

With a solid structure in basic and technological evaluation, currency exchange investors can dramatically improve their decision-making process by leveraging numerous trading devices. One important trading tool is the financial calendar, which aids investors track important financial events and announcements that can impact money values. By leveraging these trading devices in combination with technical and basic evaluation, currency exchange investors can make smarter and more critical trading decisions in the vibrant forex market.

Recognizing the mental aspects of trading is necessary for currency exchange investors to navigate the psychological challenges and predispositions that can impact their decision-making procedure.

Report this page